During his presidency, Donald Trump’s administration adopted a protectionist economic policy under the banner of “America First.” One of the key components of this approach was the imposition of tariffs on imports, especially from countries like China, India, and members of the European Union. These tariffs were aimed at reducing the U.S. trade deficit and encouraging domestic manufacturing. However, they had ripple effects on global trade dynamics, including in India.

For India, Trump’s tariffs meant a dual impact. First, certain Indian goods, like steel and aluminum, were subjected to additional duties when exported to the U.S., making them less competitive in the American market. This directly affected Indian exporters and reduced foreign exchange earnings. Second, as the U.S. took a tough stance, India retaliated by imposing its own tariffs on American goods such as almonds, apples, and walnuts, disrupting the bilateral trade balance.

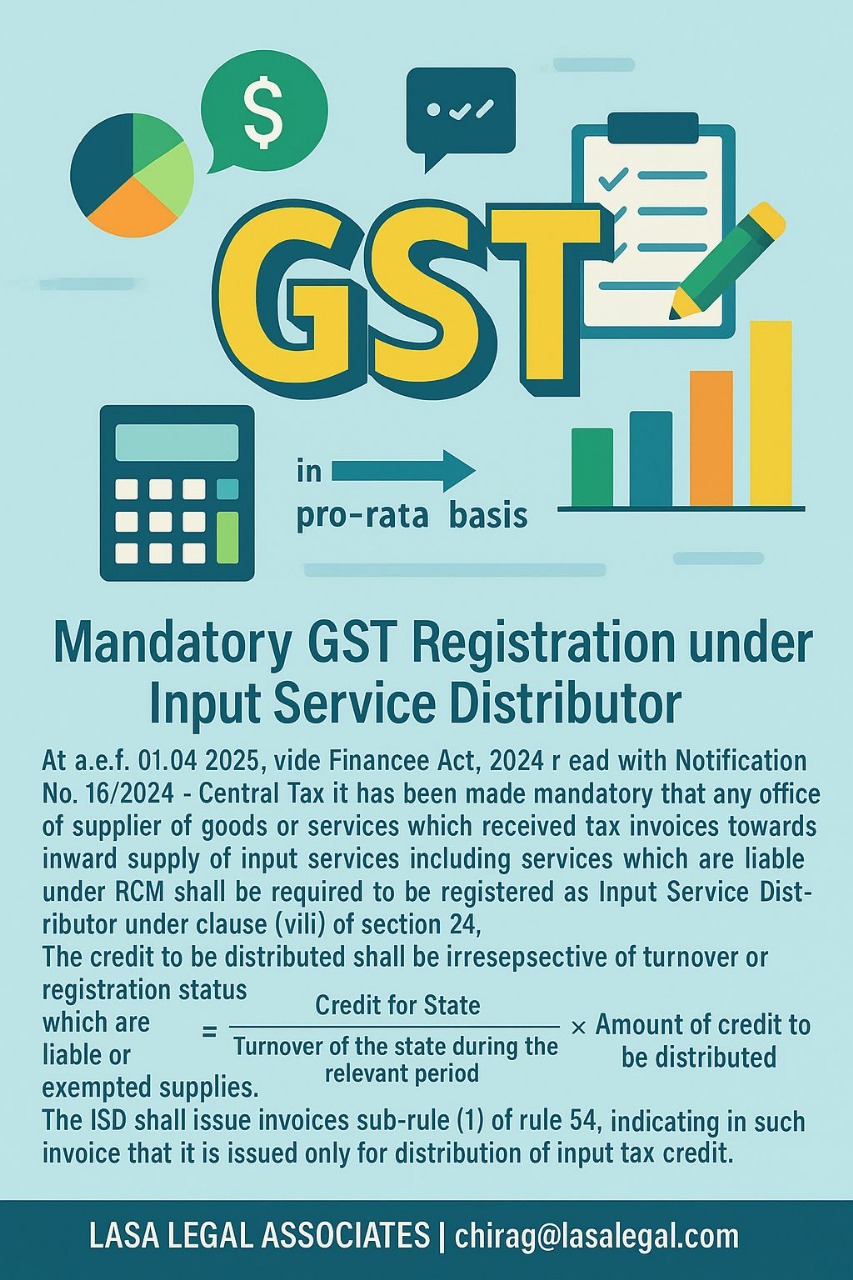

From a taxation perspective, these developments had notable implications. Indian customs duties were adjusted to counterbalance U.S. tariffs, reflecting a more assertive use of fiscal tools in foreign trade policy. Moreover, Indian policymakers began re-evaluating their dependence on exports to the U.S. and explored diversifying trade partnerships and markets. It also highlighted the need for a more robust internal taxation structure to support local industries, which fed into later reforms like the streamlining of the Goods and Services Tax (GST).

In the long term, Trump’s tariff strategy contributed to a global environment of trade uncertainty. For India, it underscored the importance of tax flexibility, strategic trade alliances, and the role of domestic taxation in shielding the economy from external shocks.

Trump’s tarrif and Indian Market Theoretical view

- Home

- Trump’s tarrif and Indian Market Theoretical view