The Goods and Services Tax (GST), implemented on 1st July 2017, marked one of the most significant tax reforms in independent India. It replaced a complex system of multiple indirect taxes—such as VAT, service tax, excise duty, and central sales tax with a unified tax structure across the country. The aim was to simplify taxation, reduce the cascading effect of taxes, and create a single national market.

Over the last eight years, GST has evolved steadily. It has transformed the way businesses comply with tax laws and has made tax administration more transparent and technology-driven. Online return filing, automated systems, and digital payments have improved the ease of doing business and encouraged more businesses to enter the formal economy.

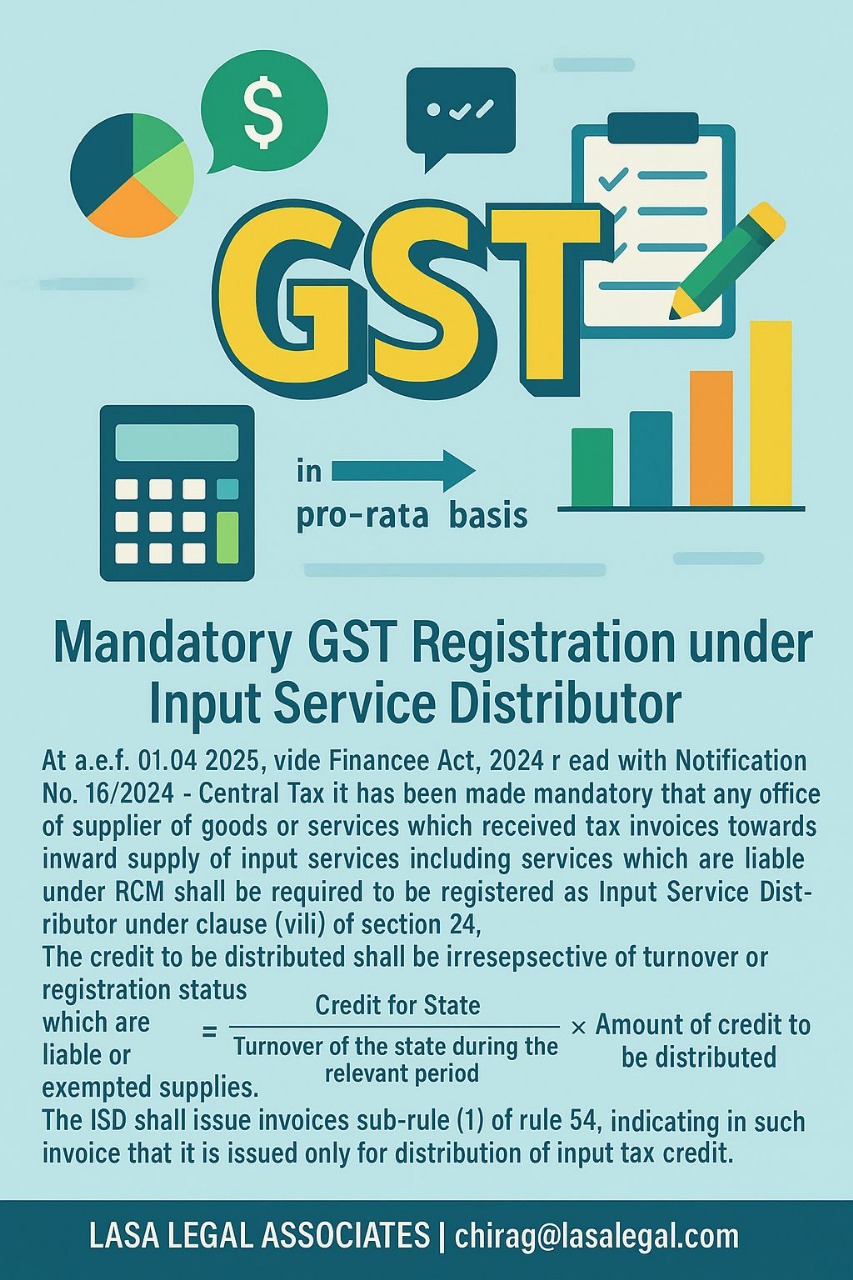

One of GST’s major achievements is the creation of a single tax regime. This has helped businesses claim seamless input tax credits and reduced overall tax burdens. It has also expanded the taxpayer base, especially among small businesses, while improving tax compliance through better monitoring and analytics.

However, GST’s implementation came with challenges. In the initial phase, many businesses struggled with the new system due to a lack of clarity and digital readiness. The GST portal faced technical issues, leading to delays and confusion. Frequent changes in tax rates and the existence of multiple slabs added complexity. Small and Medium Enterprises (SMEs), in particular, found it difficult to manage the compliance and reporting requirements.

Some GST rules were also initially unclear, leading to varied interpretations and legal disputes. Additionally, in the early years, revenue collections fell short of expectations. Despite these concerns, the system has matured significantly. As of 30th June 2025, the Finance Ministry reports an average monthly GST collection of ₹1.84 lakh crore, reflecting improved compliance and growing economic activity.

Conclusion

As GST completes eight years, it stands as a landmark reform that has redefined indirect taxation in India. While challenges remain, such as simplifying the rate structure and further easing compliance for smaller businesses, the overall impact of GST has been profoundly positive. It has laid the foundation for a more integrated, transparent, and efficient tax system that supports India’s economic growth.

The constant efforts by the government, including regular updates from the GST Council and technological upgrades, have ensured that the system adapts to changing business needs. Moving forward, GST is expected to play a crucial role in enhancing the formal economy and fostering ease of doing business.

For businesses, understanding GST and staying compliant will remain essential to leverage its benefits fully. For policymakers, the focus should continue on making the GST framework simpler and more flexible, ensuring that the tax system is equitable and encourages entrepreneurship.

In summary, GST has not just transformed India’s tax landscape but has also created a path for sustained economic progress by bringing more businesses into the formal economy, improving tax transparency, and boosting government revenue. As India continues to grow as a global economic power, GST will remain a vital pillar supporting this journey.

Sources-