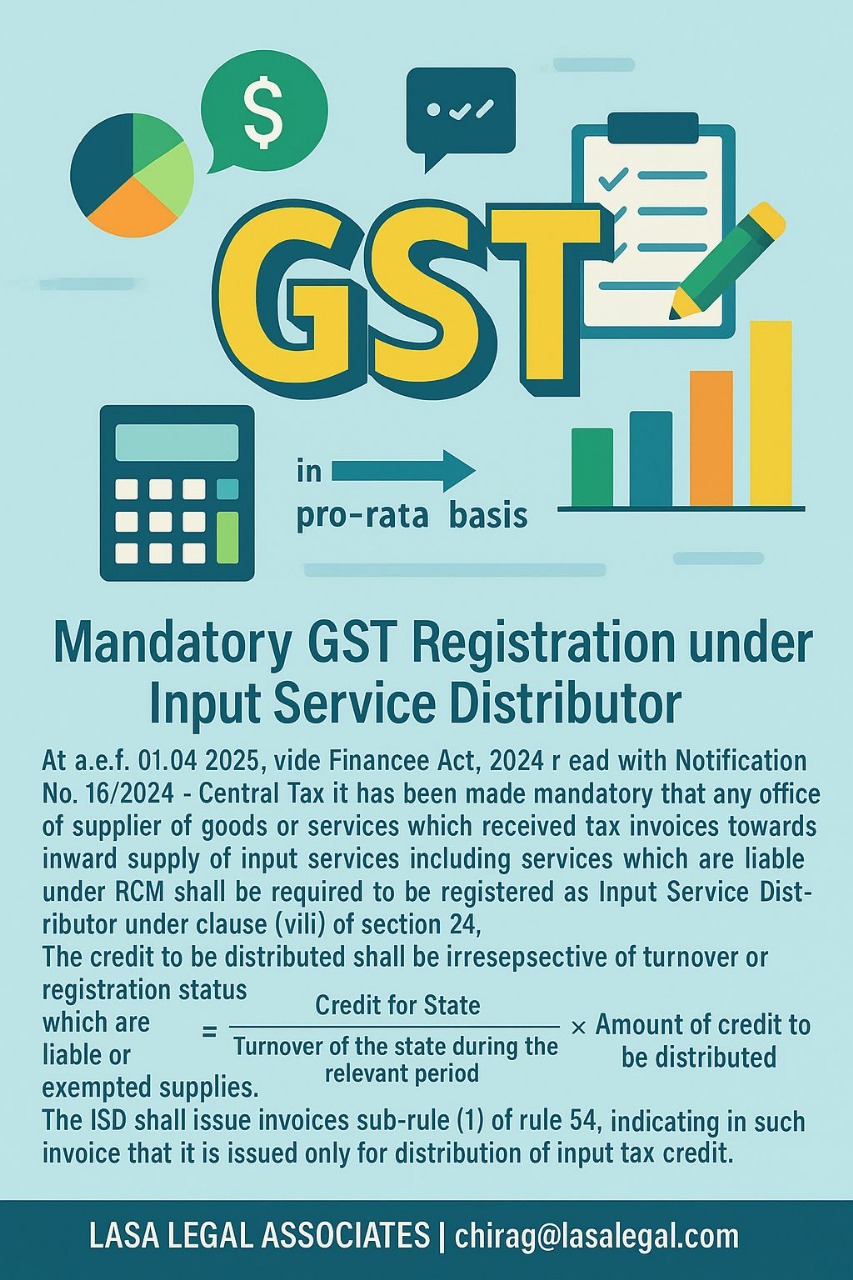

The Finance Act, 2024, in conjunction with Notification No. 16/2024 – Central Tax, has introduced a significant compliance shift under the Goods and Services Tax (GST) framework, mandating registration under the Input Service Distributor (ISD) mechanism for specific categories of offices. Effective April 1, 2025, this change requires organisations receiving input service invoices—including those under Reverse Charge Mechanism (RCM)—to obtain ISD registration, irrespective of their turnover or regular GST registration status.

This development marks a departure from the previous regime, where ISD registration was largely optional and operationalised at the discretion of the taxpayer.

Understanding the Input Service Distributor (ISD) Mechanism

The ISD mechanism under GST is designed to streamline the flow of input tax credit (ITC) within multi-location entities. An ISD is typically a centralised office (such as a head office or shared services centre) that receives tax invoices on inward supply of input services and distributes the eligible credit to its various registered branches or units located in different states.

Previously, ISD registration was more common in large conglomerates and was used voluntarily. However, with the 2024 amendment, a new statutory obligation arises.

Legal Basis: Section 24(viii) and New Mandate

Under Section 24(viii) of the CGST Act, 2017, registration is mandatory for ISDs. The Finance Act, 2024, read with Notification No. 16/2024 – Central Tax, clarifies and makes compulsory that any office receiving tax invoices for inward supply of input services (including RCM-liable services) shall register as an ISD.

This move brings clarity and uniformity to ITC allocation, especially where input services such as consulting, legal, or advertising are centrally procured but consumed across different states or branches.

Key Highlights of the Amendment (w.e.f. 01.04.2025)

- Mandatory Registration: Any office receiving tax invoices for input services must obtain ISD registration.

- No Turnover Threshold: The applicability is irrespective of the entity’s turnover or its existing GST registration status.

- Inclusion of RCM Services: Even inward supplies that attract GST under Reverse Charge Mechanism must be routed through the ISD model.

- Credit Distribution via Invoice: ISDs are now required to issue invoices under Rule 54(1), clearly marked as “issued only for distribution of input tax credit”.

- Pro-Rata Distribution Formula: Input tax credit must be distributed to branches or units in proportion to the turnover of the recipient state during the relevant period.

Compliance Challenges and Implications

This change significantly impacts businesses with decentralised operations, especially in sectors such as IT/ITeS, retail, pharmaceuticals, financial services, and logistics.

Practical Issues Businesses Must Address:

- ISD Setup: Entities must identify and register a centralised ISD unit.

- System and Process Alignment: ERP systems need updates to record, segregate, and allocate input services correctly.

- Documentation: ISD invoices must strictly comply with Rule 54 specifications.

- RCM Tracking: RCM services procured centrally need routing through ISD for appropriate credit distribution.

- Cross-State Allocation: Accounting teams must ensure the turnover-based allocation aligns with GST records to avoid mismatches and disputes.

Illustrative Example

Let’s assume a company headquartered in Mumbai procures consulting services for ₹10,00,000 (with ₹1,80,000 GST) that benefits its operations in Maharashtra, Karnataka, and Gujarat.

State-wise turnover (last financial year):

- Maharashtra: ₹50 crores

- Karnataka: ₹30 crores

- Gujarat: ₹20 crores

Total turnover = ₹100 crores

Input tax credit distribution:

- Maharashtra: (50/100) × ₹1,80,000 = ₹90,000

- Karnataka: (30/100) × ₹1,80,000 = ₹54,000

- Gujarat: (20/100) × ₹1,80,000 = ₹36,000

The head office will issue ISD invoices to each of these three states accordingly.

Legal and Strategic Advisory

For clients navigating these changes, Lasa Legal recommends the following immediate actions:

- Conduct a GST impact assessment on your procurement processes and current ITC flows.

- Identify all inward input services (including under RCM) being received at the central level.

- Establish ISD registration well ahead of the effective date (April 1, 2025).

- Train finance and tax teams on new ISD compliance workflows and documentation.

- Coordinate with ERP providers to ensure system readiness for credit allocation and ISD invoice generation.

Conclusion

The 2024 amendment is a strategic effort by the GST Council to ensure transparent, auditable, and uniform distribution of input tax credit, particularly where shared services are involved. By making ISD registration mandatory, the law now compels businesses to formalise ITC allocation, reducing the scope for inter-state mismatches or wrongful credit claims.

Non-compliance could lead to audit flags, interest liabilities, and ITC reversal. Businesses must act now to adapt processes and ensure seamless transition before the compliance deadline.

Need Help Navigating ISD Compliance?

Lasa Legal’s indirect tax team can assist with ISD registration, credit flow mapping, and system implementation support. Get in touch with us today to schedule a compliance review.